本篇主要由百度翻译解释,Jingyi 会依据现实状况,对文章部分词句作出调整。

译文

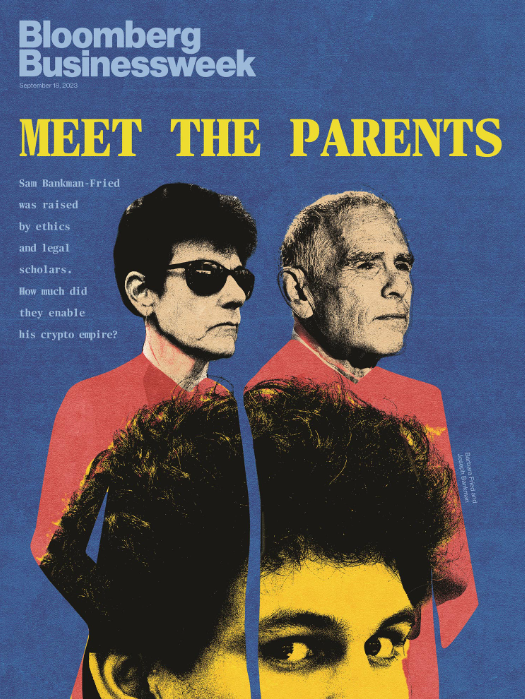

欢迎收看Bw Reads,这是我们的周末时事通讯,它将彭博商业周刊的一篇富有洞察力的杂志故事完整地免费带到您的收件箱。今天,我们将介绍 Max Chafkin 和 Hannah Miller 关于 Sam Bankman Fried(Sam or SBF) 的最新封面故事,特别是他的斯坦福大学教授父母 Barbara Fried 和 Joseph Bankman 的影响,主要是其对加密货币的影响,这些影响在 Sam 事业下降之前达到顶峰。这是一个有趣的视角,探讨了特权是如何运作的,以及它如何掩盖,那些更为人所熟知的后代身上,更可能显现的问题。你也可以在这里听这个故事。要从《商业周刊》获得更多信息,请在此处注册。

注意:

1.ShoelessCai 评注,上述观点是我们网站所同意的,也是我们努力工作的宗旨。

2.cover story on … 关于……的封面故事

3.Sam Bankman-Fried borned in CA, 1992. who had run a company to trade crypto. Here are his lateset stories.

Sep. 13, 2023, 2:04 AM ET (Reuters)

Sam Bankman-Fried loses bid for pretrial jail release

Sep. 9, 2023, 11:03 PM ET (Yahoo Finance)

Sam Bankman-Fried demands pre-trial release from detention center, citing faulty internet

在 Sam 房子周围,Larry David 最受宠。因此,当父母收到儿子 Sam 的电子邮件时,他们的兴奋是可以理解的。他写道,他的公司FTX将在2022年超级碗期间播放一则广告,David 将出演该广告。

注意:

1.was a family favor 最受宠

2.David is starring in it 大卫将出演该广告,这是百度翻译。译者未作修改。

这位脾气暴躁的喜剧演员将在历史上扮演连续怀疑论者,基本上是[1]新石器时代和伊丽莎白时代版本的[2]HBO电视台《抑制你的热情》中他所扮演的 角色。有人会提出一项发明——轮子、灯泡、随身听,最后还有FTX——大卫会很快相继驳回每一项发明。该广告将警告观众,如果他们不投资加密货币,他们将错过一个致富的历史性机会。标语:“不要像拉里那样。”

注意:

1.curmudgeonly 脾气坏的人,心存不良的人

2.a series of skeptics 连续怀疑论者

3.[1][2]为长句子中的形容词编号

4.in succession 相继

Sam 的父母很喜欢它。“超现实,” Babara Fried 写道。他的父亲 Joseph Bankman 滔滔不绝地说他是多么的快乐和自豪。几天后,员工们收到了 Gabe 的一些额外反馈,他是 Sam 的弟弟。他问他的父亲是否可以在广告中扮演一个角色,说他太谦虚了,不能自己提出这个要求(结果让弟弟发邮件)。

注意:

1.gushed over how happy and proud he was 滔滔不绝地说道,他有多骄傲和开心

2.至此,译者并未太看懂。大致意思是,Sam 这个人运营了一家和虚拟货币相关的业务,结果某天忽然说要在超级碗播放一则广告。那么,为什么这么做?并且,对事业的影响是什么呢?让我们拭目以待。

从某种意义上说,这个要求很奇怪。Sam 当时在FTX没有正式的职位。Gabe 也没有,他经营着一家由 FTX 支持的非营利组织,致力于预防流行病。但 FTX 的执行关们理解为,公司的角色(尤其是与联合创始人和首席执行官有关的角色)要模糊得多。

不久之后,Sam 出现在片场,David 强烈反对《独立宣言》。当被告知“人民有权投票”时,David 难以置信地回应道:“即使是愚蠢的人?(也要这么干吗?)”戴着粉末假发的 Sam 喊道:“是的!”FTX花了大约 2000 万美元制作并播出了这个 60 秒的节目。大约在同一时间,Bankman 以员工身份加入了公司。

注意:

1.show up on set for a scene 出现在片场

2.vehemently 激烈地,竭尽所能地

3.incredulously 难以置信地

A screenshot of FTX’s Super Bowl commercial with Larry David. Source: YouTube

一位熟悉该广告制作的人士,和所有参与该故事面试的人一样,这位被访者要求匿名,为了避免大面积破产、大量不同群体的诉讼、或者遭受一些犯罪案件。该人士表示,关于在本广告中留给老板的老爸一个角色这件事,某种意义上,也显示了 FTX 颠倒的逻辑。(这种做法)用了某种方式,昭示 Bankman 是这家公司创始人的老爸。译者注:本文之后所谓 Bankman 均为 Sam 的老爸。

注意:

1.request anonymity 要求匿名

2.numerous class-action lawsuits 大量不同群体的诉讼

3.made a certain sense within the upside-down logic 某种意义上是 XXX 的一部分

在儿子被指控欺诈之前,父母都有着杰出的职业生涯。他们于20世纪80年代在斯坦福大学相识,在那里他们在法学院任教了30多年,住在校园里,养育了两个儿子。Bankman 是一位税务专家,他以使美国税法对低收入公民更友好而闻名。Fried 是一位法律伦理权威,在进步政治圈中业绩很突出。

注意:

1.distinguish career 拥有杰出的职业生涯

2.one's alleged fraud 被指控欺诈

3.be renowned for 由……而闻名

广告播出时,批评人士警告称,FTX正在用风险极高的金融工具引诱天真的投资者,而这些金融工具在美国大多被禁止。这些资金在他们不知情的情况下被转移到 Bankman Fried 也拥有的对冲基金,这些投资者会看到他们的钱消失。FTX于2022年11月倒闭并申请破产。

注意:

1.without their knowledge 在他们不知情的情况下

2.see their money vanish 看到他们的钱消失

3.该段讲述了,Sam 为什么会被起诉。

Featured in Bloomberg Businessweek, Sept. 18, 2023. Photo illustration: Arsh Raziuddin; photos: Getty Images; Josh Edelson

领导破产程序的是 John Ray 三世,他为安然公司做了同样的事情,并将此案描述为更糟。他指控 Bankman-Fried 利用客户资金来致富,以及他的家人和其他内部人士,并试图收回其中的一部分资金。对 Bankman Fried 夫妇来说,更不祥的是定于10月2日在纽约市开庭的刑事案件。检察官尚未指控这对父母有不当行为,但对他们的儿子的指控包括欺诈、洗钱和贿赂。他们的儿子在鼎盛时期的净资产估计为260亿美元。此案可能会让 Bankman-Fried 终身入狱。他不认罪,并将损失定性为管理不善,但并非犯罪。

注意:

1.pleaded not guilty 他不认罪

2.has characterized the losses as the result of inept 将损失定义为能力不足

Bankman 和 Fried 避开了围绕FTX的许多审查。这至少在一定程度上是因为他们还没有全面说明自己在帮助儿子建立庞大的商业和政治影响力方面所扮演的角色。相反,他们通常被描绘成观众,经常流着泪,在频繁的法庭上为儿子提供情感支持。但他们的名字几乎肯定会在审判期间出现。辩护团队表示,他们的策略可能在一定程度上取决于 Bankman-Fried 从律师那里得到的建议,包括他的父母。

注意:

1.that is enveloped FTX 围绕着 FTX 的

2.have not yet to delvier a full accounting of their roles 尚未解释清楚他们的角色

3.build a sprawling business and political-influence operation 建立庞大商业及政治影响力

这对夫妇的发言人 Risa Heller 拒绝让 Bankman 或者 Fried 接受采访。她之前说过,除了作为父母之外,两人都与FTX没有太大关系。据 Heller 介绍,Fried 从未为该公司工作过,Bankman 的短暂任期主要集中在慈善事业上。去年,班克曼·弗里德(Bankman-Fried)告诉《纽约时报》,他的父母“没有参与公司的任何相关部门”。

前员工和商业伙伴表示,这不是他们当时的印象,法律文件表明,班克曼和弗里德对他们儿子从一个笨拙的创业书呆子转变为超级互联的加密货币大亨至关重要。这对夫妇从FTX中获利颇丰,仅在2022年就净赚2600万美元现金和房地产。他们是公司办公室的“固定装置”(regular fixture),向员工提供鼓励的话语,并被纳入公司内部沟通。他们的声誉和关系对FTX的成功至关重要。

注意:

1.were crucial to 对…至关重要

2.transfiguration from schlubby startup nerd to hyperconnected crypto mogul 从创业书呆子向加密货币大亨转变

3.最后一句指的是,父母虽然没有参与管理,但是经常出现在办公室,并给予鼓励。

这篇 Mailshot 比较长,鉴于篇幅的关系,暂时翻译至此。通篇主要就最近 Sam Bankman Fried 面临各项控诉,开展了相对全面的了解和调查。ShoelessCai 如果最近有空余时间,补出新的翻译。

原文

Welcome to Bw Reads, our weekend newsletter that brings an insightful magazine story from Bloomberg Businessweek right to your inbox, in its entirety—and for free. Today we’re featuring Max Chafkin and Hannah Miller’s latest cover story on Sam Bankman-Fried—specifically, the influence of Barbara Fried and Joseph Bankman, his Stanford professor parents, on his trajectory to the top of crypto before his fall. It’s a fascinating look into how privilege works, and how it can mask problems that might have been more apparent with a less credentialed offspring. You can also listen to this story here. To get more from Businessweek, sign up here.

Around the Bankman and Fried house, Larry David was a family favorite. So the parents were understandably excited when they got the email from their son Sam. He wrote that his company, FTX, would be airing a commercial during the 2022 Super Bowl and that David was starring in it.

The curmudgeonly comedian would play a series of skeptics throughout history, basically Neolithic and Elizabethan versions of his character from HBO’s Curb Your Enthusiasm. Someone would present an invention—the wheel, the lightbulb, the Walkman and, finally, FTX—and David would dismiss each one in quick succession. The ad would warn viewers that if they didn’t invest in crypto, they were missing out on an historic opportunity to get rich. The tag line: “Don’t be like Larry.”

Sam Bankman-Fried’s parents loved it. “Surreal,” wrote Barbara Fried. His dad, Joseph Bankman, gushed over how happy and proud he was. A few days later, employees received some additional feedback from Sam’s younger brother, Gabe. He asked if his dad could have a role in the commercial, saying he was too humble to make the request himself.

The request was odd in a sense. Bankman had no formal role at FTX at the time. Nor did Gabe, who was running an FTX-backed nonprofit dedicated to preventing pandemics. But executives at FTX understood that corporate roles, especially as they related to the co-founder and chief executive officer, were much blurrier.

Not long afterward, Bankman showed up on set for a scene in which David vehemently opposed the Declaration of Independence. When told “the people shall have the right to vote,” David responded incredulously: “Even the stupid ones?” Bankman, wearing a powdered wig, shouted, “Yes!” FTX paid roughly $20 million to create and air the 60-second spot. Around the same time, Bankman joined the company as an employee.

[pic]

A person familiar with the commercial’s production—who, like most people interviewed for this story, requested anonymity to avoid being associated with a messy bankruptcy, numerous class-action lawsuits and several criminal cases—says the decision to give the boss’s dad a role made a certain sense within the upside-down logic of FTX. In a way, Bankman was the company’s founding father.

Both parents have distinguished careers that long precede their son’s alleged fraud. They met in the 1980s at Stanford University, where they taught at the law school for more than three decades, living on campus and raising two sons. Bankman, an expert on taxes, is renowned for his work making the US tax code friendlier to lower-income citizens. Fried, an authority on legal ethics, was prominent in progressive political circles.

At the time the ad aired, critics were warning that FTX was luring naive investors with extremely risky financial instruments that were mostly banned in the US. Those investors would see their money vanish when the funds were diverted, without their knowledge, to a hedge fund that Bankman-Fried also owned. FTX collapsed and filed for bankruptcy in November 2022.

[pic]

Leading the bankruptcy process is John Ray III, who did the same for Enron and has described this case as worse. He’s accused Bankman-Fried of using customer funds to enrich himself, as well as his family members and other insiders, and is seeking to reclaim some of that money. More ominous for the Bankman-Frieds is the criminal case, set to begin in New York City on Oct. 2. Prosecutors haven’t accused the parents of wrongdoing, but charges against their son, whose net worth at its height was estimated at $26 billion, include fraud, money laundering and bribery. The case could send Bankman-Fried to prison for the rest of his life. He pleaded not guilty and has characterized the losses as the result of inept, but not criminal, management.

Bankman and Fried have steered clear of much of the scrutiny that’s enveloped FTX. That’s at least in part because they’ve yet to deliver a full accounting of their roles in helping their son build a sprawling business and political-influence operation. Instead, they’ve generally been portrayed as spectators, who, often in tears, offer emotional support to their son at frequent court appearances. But their names will almost certainly come up during the trial. The defense team has signaled its strategy may, in part, rest on advice Bankman-Fried received from lawyers, including his parents.

A spokeswoman for the couple, Risa Heller, declined to make Bankman or Fried available for interviews. She’s said previously that neither one had much to do with FTX beyond being a supportive parent. Fried never worked for the company, and Bankman’s brief tenure mostly focused on philanthropy, according to Heller. Last year, Bankman-Fried told the New York Times that his parents “weren’t involved in any of the relevant parts” of his company.

Former employees and business partners say this wasn’t the impression they had at the time, and legal filings suggest Bankman and Fried were crucial to their son’s transfiguration from schlubby startup nerd to hyperconnected crypto mogul. The couple profited tremendously from FTX, netting $26 million in cash and real estate in 2022 alone. They were regular fixtures at the company’s offices, offered words of encouragement to employees and were included in internal company communications. Their reputations and connections were essential to FTX’s success.